In commercial banking, customer onboarding is the process by which a bank determines whether to do business with a client, and on what terms and conditions. KBY-AI offers powerful solutions such as face liveness, face comparison, document OCR, document anti-spoofing to support customer onboarding system.

Commercial banking, which has generally lagged in adopting newer technology, is now laser-focused on innovating customer experience. Many consider it a competitive differentiator. Since customer onboarding is one of the first impressions customers get of their banks, it is a critical component of their experience.

Banks are now embracing digital to meet customer expectations and craft unique experiences, while striving to automate and improve customer onboarding efficiency.

To enhance and automate customer onboarding processes efficiently, we recommend exploring KBY-AI‘s SDKs for face liveness detection, face matching, ID card recognition, and ID document liveness verification.

This article delves into client onboarding in commercial banking, where banks facilitate account openings to grant clients access to various products and services. It examines the key stages of the onboarding process to explore its scope, business workflows, supporting systems, challenges, and opportunities, all within the context of emerging digital paradigms and increasing customer expectations.

Customer Onboarding Overview

Customer onboarding is the first stage of the customer journey once they begin using a product or service. This stage of the customer journey often defines their relationship with a product or brand. It is vital to make this experience as positive as possible. The more complex the product, the more strategic the customer onboarding process must be. SaaS products, for instance, can require orientation, training, and ongoing correspondence.

In commercial banking, customer onboarding is the process by which a bank determines whether to do business with a client, and on what terms and conditions. Banks conduct a detailed examination of related risks, set up operational modalities around products and services, and prepare related legal contracts and documentation.

This is an extremely complex function, because the clients tend to be large businesses with elaborate structures, and the process typically requires multiple elements:

- Customer Research and Qualification

- Risk Assessment & Credit Underwriting

- Complex Contract & Commercial Negotiations

- Executing Legal Documentation & Contract

- Manage Associated 3rd Parties/Vendors/Agencies

- A/c Openings, Product Set-up, IT Integrations

- Detailed Customer Due-Diligence

- Complex Decision Making

- Local & International Regulatory Compliance

- Multiple Banking Products and Services

- Continuous Relationship and Communication Management

- Coordination Across Units (sales, Ops, risk, IT etc)

This complexity results in longer onboarding cycles. In many instances, the same client needs multiple onboardings—one for each line of business—because the underlying systems and processes are not integrated and operate in silos.

The Customer Onboarding Process

Whether onboarding a new client or introducing a new service to an existing client, it is crucial to consider the inherent complexity of the end-to-end process.

Different departments are responsible for capturing data, while others handle the exchange, retrieval, or analysis of information. The process becomes even more intricate—often significantly different—when banks operate across jurisdictions with varying regulations and market practices.

The overall customer onboarding process can be divided into two main segments: customer onboarding and product/service onboarding.

Problem Statement

In the banking relationship, customer onboarding represents the first step of the customer journey. This process often takes several weeks—or even months in some cases—due to its complexity, compliance challenges, and inefficient workflows. These issues contribute to suboptimal customer experiences, higher onboarding costs, and lost revenue for banks.

Onboarding processes are rarely designed with the customer in mind. Instead, they are often hampered by technological, procedural, and regulatory hurdles. Historically, most banks regarded customer onboarding as a back-office function rather than a potential competitive differentiator.

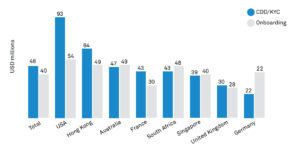

Since 2008, global financial institutions have collectively faced $26 billion in fines for non-compliance with anti-money laundering (AML) and know-your-client (KYC) regulations. At the same time, banks have implemented stricter controls, further driving up onboarding costs and creating a double burden for institutions. Current onboarding processes remain predominantly manual, error-prone, incomplete, inefficient, and costly

The Way Forward: Digital Customer Onboarding Platform

With the growth of digital economies and shifting customer behaviors, banks must prioritize customer-centric onboarding to enhance their competitive edge, drive revenue growth, and reduce costs.

Achieving this requires an innovative, digital-first approach.

Digital onboarding enables banks to meet the evolving demands of the marketplace while streamlining processes and systems to be more flexible, adaptive, and efficient.

Successfully building and implementing this new onboarding process demands a balanced focus on both features and business functions, coupled with an incremental and iterative rollout strategy.

When executed effectively, digital onboarding can maximize return on investment and enhance customer impact by improving process efficiency, elevating data quality, ensuring service consistency, and strengthening risk management capabilities.

Frequently Asked Questions

Why is digital customer onboarding important for commercial banks?

Digital customer onboarding simplifies the process for customers, reducing paperwork, time, and effort. It enhances customer satisfaction and allows banks to onboard clients more efficiently, ensuring compliance and minimizing operational costs.

What are the key features of a successful digital onboarding platform?

A successful digital onboarding platform includes seamless user experience with minimal steps, robust identity verification, integration with CRM systems, compliance with regulations and multi-device compatibility.

How does biometric authentication enhance digital onboarding?

Biometric authentication ensures a secure and fraud-free onboarding experience by verifying a customer’s unique traits, such as facial recognition or fingerprint. This prevents identity theft and enhances trust between banks and customers.

How can banks measure the success of digital onboarding?

Success can be measured through customer satisfaction scores, conversion rates of new customers, reduced onboarding time, compliance metrics, and decrease in manual errors and operational costs.

Where can I get powerful customer onboarding solutions?

Just reach out to KBY-AI company, which is powerful identity verification SDK provider.

Conclusion

Reimagining the corporate client onboarding experience is a complex and challenging endeavor for banks, but meaningful improvements are achievable. The shared goal is to apply service design principles to reduce complexity and transform underlying processes, thereby enhancing the customer experience. However, the transformation roadmap will vary for each bank, shaped by its unique context, pain points, priorities, and the size and scale of its onboarding operations.

Achieving this transformation requires a strategic blend of digital interventions, the adoption of new technologies, and the embrace of hyper-automation. Equally important is having a clear vision of the objectives, balancing quick wins with a phased implementation approach. This ensures lasting success while maximizing return on investment.