eKYC verification SDK is the library which supports a process that verifies a person’s identity through electronic means, ensuring accuracy and security. In today’s digital world, where identity theft is a growing concern, eKYC plays a crucial role in safeguarding sensitive information and preventing fraudulent activities.

This process involves the use of technology, such as biometrics and document verification, to verify the authenticity of an individual’s identity, ensuring that they are who they claim to be. Implementing eKYC verification not only enhances security measures but also streamlines various digital processes, making it an essential tool for businesses, financial institutions, and government agencies alike.

Enhancing Verification With eKYC Solutions

Identity verification is a critical process for businesses across various industries. From financial institutions to e-commerce platforms, verifying the identity of customers is essential to protect against fraudulent activities and comply with regulatory requirements. With the advent of technology, the verification process has evolved, and one such innovation gaining traction is Electronic Know Your Customer (eKYC) solutions.

Benefits Of Integrating eKYC verification SDKs Into Your Verification Process

Integrating eKYCverification SDK into your verification process brings numerous benefits, making it an attractive option for businesses. Here are the key advantages:

- Increased accuracy: With eKYC solutions, the likelihood of errors and manual mistakes is significantly reduced. Automated processes ensure that information is captured accurately, eliminating discrepancies caused by human error.

- Enhanced security: eKYC verification solutions leverage advanced technology such as biometrics and facial recognition, making it difficult for fraudsters to bypass verification. This added layer of security ensures that only legitimate individuals gain access to your services.

- Streamlined customer experience: Traditional verification methods often involve cumbersome processes that require customers to submit physical documents and undergo manual checks. eKYC verification solutions streamline this experience by enabling digital verification, reducing friction and eliminating time-consuming paperwork.

- Cost and time efficiency: By automating the verification process, eKYC verification solutions save businesses significant time and resources. Manual verification can be time-consuming and costly, whereas eKYC minimizes the need for extensive manual intervention, allowing businesses to allocate resources more efficiently.

Key Industries Revolutionized By eKYC Verification Technology

eKYC verification technology has made a significant impact on several industries, revolutionizing their identity verification processes. Here are a few prominent sectors benefiting from the implementation of eKYC verification functionality:

| Financial Services | Telecommunications | E-commerce |

|---|---|---|

| With eKYC, financial institutions can onboard customers remotely and verify their identities without the need for physical visits. This improves convenience for customers while ensuring compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations. | Telecommunications companies can streamline the process of customer onboarding and SIM card activation by integrating eKYC verification SDK. Remote verification reduces the hassle for customers and accelerates the provisioning of services. | In the e-commerce industry, eKYC simplifies the customer registration process, making it easier for businesses to expand their customer base. By eliminating the need for manual verification, eKYC verfication process enables faster onboarding, reducing cart abandonment and increasing conversions. |

Common Challenges Faced Without eKYC

Without eKYC verification solutions, businesses encounter various challenges throughout the identity verification process. The most common difficulties include:

- Inaccurate data entry resulting in errors and discrepancies

- Manual verification processes leading to longer onboarding times and delays

- Increased exposure to fraudulent activities and identity theft

- Higher operational costs due to extensive manual intervention

eKYC Verification In Action

Identity verification is a crucial process for businesses and organizations across various industries. It helps ensure the authenticity of individuals and protects against fraud and identity theft. One of the most effective methods of identity verification is electronic Know Your Customer (eKYC), which leverages technology to streamline and enhance the verification process.

Real-world Examples Of Improved Verification Processes

eKYC verification has revolutionized the way identity verification is conducted, making it faster, more accurate, and more convenient. Let’s take a look at some real-world examples of how eKYC has improved verification processes:

1. Financial institutions: Banks and other financial institutions often face challenges when it comes to verifying the identities of their customers. With eKYC, the process has become significantly more efficient. By using digital technology, financial institutions can verify customer identities remotely and in real-time, eliminating the need for customers to physically visit a branch or submit physical documents. This not only saves time but also reduces costs and improves the overall customer experience.

2. Online marketplaces: Online marketplaces and e-commerce platforms frequently deal with identity verification issues, especially when onboarding new sellers or buyers. With eKYC, these platforms can verify the identities of their users quickly and accurately. By integrating eKYC verification solutions into their onboarding processes, platforms can authenticate user identities by leveraging data from various sources, such as government databases and biometric information. This ensures the legitimacy of users and enhances trust within the marketplace.

Impact On Customer Onboarding And Experience

Implementing eKYC verification functionality not only improves the verification process but also has a significant impact on customer onboarding and experience:

- Streamlined onboarding: eKYC eliminates the need for cumbersome paperwork and reduces the time required for identity verification. This means customers can onboard more quickly and easily, enhancing the overall onboarding experience.

- Convenience: With eKYC, customers can verify their identities remotely, anytime, and anywhere. This eliminates the need for them to visit physical locations or submit physical documents, making the process much more convenient for customers.

- Enhanced security: eKYC relies on advanced technology and data encryption to ensure the security and privacy of customer information. This gives customers peace of mind knowing that their sensitive data is protected.

- Improved trust: By implementing robust identity verification processes, businesses can build trust with their customers. When customers feel confident that their identities are secure, they are more likely to engage with the business and establish long-term relationships.

Metrics To Evaluate Ekyc Efficiency

Monitoring and evaluating the efficiency of eKYC is essential to ensure its effectiveness in the verification process. Here are some key metrics businesses can use to evaluate eKYC efficiency:

| Metric | Description |

|---|---|

| Verification success rate | The percentage of successful identity verifications conducted using eKYC verification SDK. |

| Processing time | The average time taken to complete the verification process using eKYC verification SDK. |

| False-positive rate | The percentage of false-positive results generated by the eKYC verification system. |

| User satisfaction | The level of satisfaction reported by users regarding the eKYC verification process. |

| Cost savings | The amount of money saved by implementing eKYC verification functionality compared to traditional verification methods. |

Streamlining Operations With eKYC

Implementing eKYC automation can revolutionize the way businesses verify customer identities and streamline their operations. With its efficient and swift verification processes, eKYC technology significantly reduces operational overhead. Let’s explore the various aspects of eKYC automation and its impact on businesses.

How eKYC Automation Reduces Operational Overhead

eKYC automation offers several advantages over traditional manual verification processes. Let’s take a closer look at how businesses can streamline their operations and minimize costs using eKYC:

Saves Time and Resources

Manual verification processes involve repetitive tasks, such as filling out forms, scanning documents, and performing background checks. These tasks not only consume valuable time but also require dedicated personnel and resources. eKYC automation eliminates such manual interventions, allowing businesses to reallocate resources effectively.

Improves Efficiency

eKYC automation streamlines the entire verification process, ensuring a smooth and hassle-free experience for both businesses and customers. With automated data extraction and verification algorithms, errors are minimized, and information is processed quickly and accurately. This enhanced efficiency leads to faster customer onboarding and reduces the chances of delays or bottlenecks within operations.

Cost-effective Solution

By eliminating the need for physical storage, paperwork, and manual labor, eKYC automation significantly reduces operational costs. Businesses can optimize their budget allocation, redirecting resources to other critical areas that drive growth and innovation.

Comparison Of Manual Vs. Automated Verification Processes

When comparing manual and automated verification processes, it becomes evident that eKYC automation offers several advantages. Here’s a comparison highlighting the key differences:

| Manual Verification | eKYC Automation | |

|---|---|---|

| Efficiency | Prone to errors and longer processing time | highly accurate with quick processing |

| Resource Allocation | Requires dedicated personnel and physical storage | Minimizes resource requirements, allowing allocation to other areas |

| Cost | High operational costs due to manual labor and paperwork | Significantly reduces costs by eliminating manual interventions |

Implications For Data Accuracy And Fraud Prevention

Data accuracy and fraud prevention are critical concerns for businesses when verifying customer identities.Identity verification eKYC automation addresses these challenges effectively:

Enhanced Data Accuracy

Manual verification processes are susceptible to human error, resulting in inaccurate data and potential compliance issues. On the other hand, identity verification eKYC automation employs advanced algorithms and machine learning techniques to ensure accurate data extraction and verification. This not only improves data integrity but also enhances customer trust.

Robust Fraud Prevention

Traditional verification processes are vulnerable to fraudulent activities, as identity theft and impersonation become increasingly sophisticated. eKYC automation integrates cutting-edge technologies, such as facial recognition, document authentication, and biometric analysis, to detect and prevent fraudulent attempts effectively.

Navigating the ever-evolving landscape of identity verification requires businesses to adapt and adopt innovative solutions. eKYC automation offers a powerful toolset for streamlining operations, reducing overhead costs, ensuring data accuracy, and strengthening fraud prevention measures. By embracing eKYC, businesses can optimize their operations while maintaining stringent security standards.

Boosting Security With eKYC Technologies

Identity verification is crucial in today’s digital world where fraud and identity theft pose significant risks. Traditional methods of identification have become outdated and inadequate, paving the way for innovative solutions such as Electronic Know Your Customer (eKYC) technologies. These advancements have revolutionized the way businesses verify the identity of their customers, enhancing security and reducing the risks associated with false identities.

Advanced Features Of eKYC That Enhance Security

Identity verification eKYC technologies leverage advanced features that significantly enhance the security of identity verification processes. These features include:

| Feature | Description |

|---|---|

| Biometric authentication | Utilizes unique physiological or behavioral characteristics such as fingerprints, facial recognition, or iris scans to ensure the person’s identity matches the provided information. |

| Artificial intelligence | Employs machine learning algorithms to analyze and verify identity documents, detect forged or tampered documents, and identify suspicious patterns or discrepancies. |

| Data encryption | Secures sensitive customer data and ensures it remains confidential throughout the verification process, minimizing the risk of data breaches. |

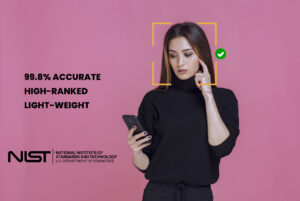

Role Of Biometrics And AI in Identity Verification

Biometrics and AI play a crucial role in enhancing the effectiveness and security of identity verification using eKYC verification technologies. Biometric authentication offers an unparalleled level of accuracy and reliability by relying on unique physical or behavioral traits. Facial recognition, for example, compares the individual’s live image with their stored biometric data to confirm their identity. Artificial intelligence algorithms, on the other hand, are capable of processing vast amounts of data and identifying fraudulent activities with remarkable precision.

Through machine learning, AI constantly evolves and adapts to new threats, detecting identity theft attempts and minimizing false positives or negatives during the verification process. This combination of biometrics and AI not only enhances security but also provides a seamless user experience by reducing the need for manual intervention.

Strategies For Maintaining Compliance With eKYC Verification

Ensuring compliance with identity verification-eKYC regulations is crucial for businesses to maintain the integrity of their identity verification processes. Here are some strategies to consider:

- Regular audits: Conduct regular audits to review the effectiveness of your eKYC verification processes, identify any vulnerabilities, and ensure compliance with regulatory guidelines.

- Data protection measures: Implement robust data protection measures, including encryption, firewalls, and access controls, to safeguard customer information and adhere to data privacy regulations.

- Employee training: Provide comprehensive training to your employees to enhance their understanding of eKYC verification procedures, compliance requirements, and the importance of data security.

- Integration with trusted data sources: Integrate your eKYC verification system with trusted data sources such as government databases or credit bureaus to verify customer-provided information and minimize the risk of fraudulent identities.

- Stay updated on regulations: Keep yourself updated on changing regulations concerning eKYC to ensure ongoing compliance and avoid potential penalties or legal issues.

By implementing these strategies, businesses can successfully maintain compliance with eKYC regulations while bolstering their security measures.

Future Of Verification In The eKYC Era

As technology rapidly evolves, businesses are embracing digital solutions to streamline operations and enhance security. In the era of eKYC (Electronic Know Your Customer), identity verification has become a crucial aspect of numerous industries. From financial institutions to online marketplaces, organizations are leveraging eKYC to ensure the authenticity and integrity of their customers. The future of verification in the eKYC era holds immense potential for advancements and industry adoption.

In this blog post, we will explore the emerging trends in identity verification technology, make predictions for eKYC advancements and industry adoption, and guide you in preparing your business for the future of eKYC integration.

Emerging Trends In Identity Verification Technology

As more businesses switch to digital platforms, the demand for robust identity verification technology continues to grow. Companies are constantly exploring new ways to enhance the accuracy and efficiency of their eKYC processes. Some of the emerging trends in identity verification technology include:

- Biometric authentication: Advancements in biometric technology, such as facial recognition and fingerprint scanning, are being integrated into eKYC solutions. These methods provide a higher level of security as they are unique to each individual.

- Artificial intelligence (AI) and machine learning (ML): AI and ML algorithms are revolutionizing the way identity verification is conducted. These technologies can analyze vast amounts of data in real-time and detect anomalies, making the verification process faster and more accurate.

- Blockchain technology: Blockchain offers a decentralized and tamper-proof solution for identity verification. By storing verified data on a distributed ledger, businesses can ensure the authenticity and integrity of customer identities.

- Data enrichment: To enhance verification accuracy, businesses are leveraging data enrichment techniques. This involves enriching customer data with additional information from various sources, such as social media profiles and publicly available records.

Predictions For eKYC Advancements And Industry Adoption

The future of eKYC holds exciting possibilities for advancements and widespread industry adoption. Here are some predictions for what we can expect:

- Mobile-first approach: With the increasing use of smartphones, mobile-based identity verification-eKYC solutions are likely to gain prominence. Mobile apps that offer seamless verification experiences will become the norm.

- Global regulatory compliance: As countries tighten regulations to combat fraud and money laundering, eKYC solutions will continue to evolve to meet these stringent requirements. Cross-border verification processes will become more standardized and globally accepted.

- Enhanced user experience: The future of eKYC will prioritize user experience while maintaining robust security measures. Simplified interfaces, shorter verification processes, and intuitive designs will create a frictionless experience for customers.

- Integration with the Internet of Things (IoT): As connected devices become more prevalent, -identity verification-eKYC solutions will integrate with IoT technologies to provide seamless and secure identity verification for various applications, from smart home devices to autonomous vehicles.

Preparing Your Business For The Future Of eKYC Integration

To stay ahead of the curve and ensure a smooth transition into the future of eKYC integration, consider the following steps:

- Evaluate your current verification processes: Assess the strengths and limitations of your existing eKYC procedures. Identify areas for improvement and determine the specific pain points that need to be addressed.

- Stay updated with regulatory changes: Keep a close eye on evolving regulations related to identity verification. Stay current with compliance requirements to ensure your business stays within the legal framework.

- Invest in advanced eKYC verification solutions: Explore various eKYC service providers that offer cutting-edge technology and robust security features. Choose a solution that aligns with your business needs and provides scalability as your customer base grows.

- Prioritize user experience: Enhance the user experience by simplifying the verification process. Minimize the number of steps involved and provide clear instructions to customers to ensure a seamless and hassle-free experience.

- Train your team: Ensure your employees are well-versed in eKYC procedures and equipped to handle any customer queries or issues that may arise during the verification process.

Frequently Asked Questions For eKYC Verification

What Is eKYC Verification?

eKYC verification is a digital process that uses electronic documents to verify a person’s identity. It eliminates the need for physical documents and is quick, secure, and convenient.

What Is Identity Verification In KYC?

Identity verification in KYC is the process of confirming the identity of individuals to ensure they are who they claim to be. It helps prevent fraud, money laundering, and other illegal activities through the use of various documents and technologies.

What Is The eKYC Process In the USA?

The eKYC verification process is a digital method used in the USA to verify and authenticate someone’s identity. It eliminates the need for physical documents by allowing individuals to provide their personal information electronically. This process is efficient, secure, and saves time for both businesses and individuals.

What Is the Difference Between KYC And eKYC?

KYC (Know Your Customer) is the process of verifying a customer’s identity through documents. eKYC (Electronic Know Your Customer) is the same process but done digitally, using biometric or Aadhaar-based authentication. eKYC offers quicker verification and is more convenient for customers.

Conclusion

Identity verification through eKYC is an essential tool in today’s digital landscape. It not only ensures secure online transactions but also helps prevent fraud and identity theft. By streamlining the identification process, eKYC offers convenience and efficiency while maintaining the highest level of data protection.

With advancements in technology, businesses and individuals can trust eKYC verification solutions to provide accurate and reliable identity verification, paving the way for safer and more seamless online experiences.